Q4, the final stretch: B2B trends to boost year-end success

As Q4 fast approaches and another year has gone by in a blink of an eye – this research looks at B2B trends around the festive period, and how brands can start to capitalise on this time of year to create real business opportunity.

Modern B2B acts much like B2C in that when the audience are in market, they want the opportunity to be able to buy everywhere and throughout the whole year. Brands need to present themselves as a dependable, in market partner and be present in both the purchase window (which is often as little as 5% of the time) and the priming period to give a real chance to be part of the buying decision process.

With the cycle being longer than ever, the ads and messaging that brands put out to their audience is even more important to be targeted and relevant to the context. Long gone are the days of wide targeting, open exchange ‘spray and pray’ and this is where we see the need for B2B specialists like Encore with exclusive sets of 1st party data, not available to buy via any other partner or platform to help provide cut through and stand out.

In 2022, the average length of the B2B sales cycle increased by 32% - with a longer lifecycle means more touchpoints in which brands have the opportunity to influence (Ebsta 2022 data.*)

32%

So, what else do we know about the B2B buyer?

After three years of seismic shifts – including further acceleration toward digital channels triggered by the pandemic* – these decision makers are rewarding brands that deliver on a great multi channel experiences. The smart use of data and targeting is tantamount to delivering success to these B2B brands.

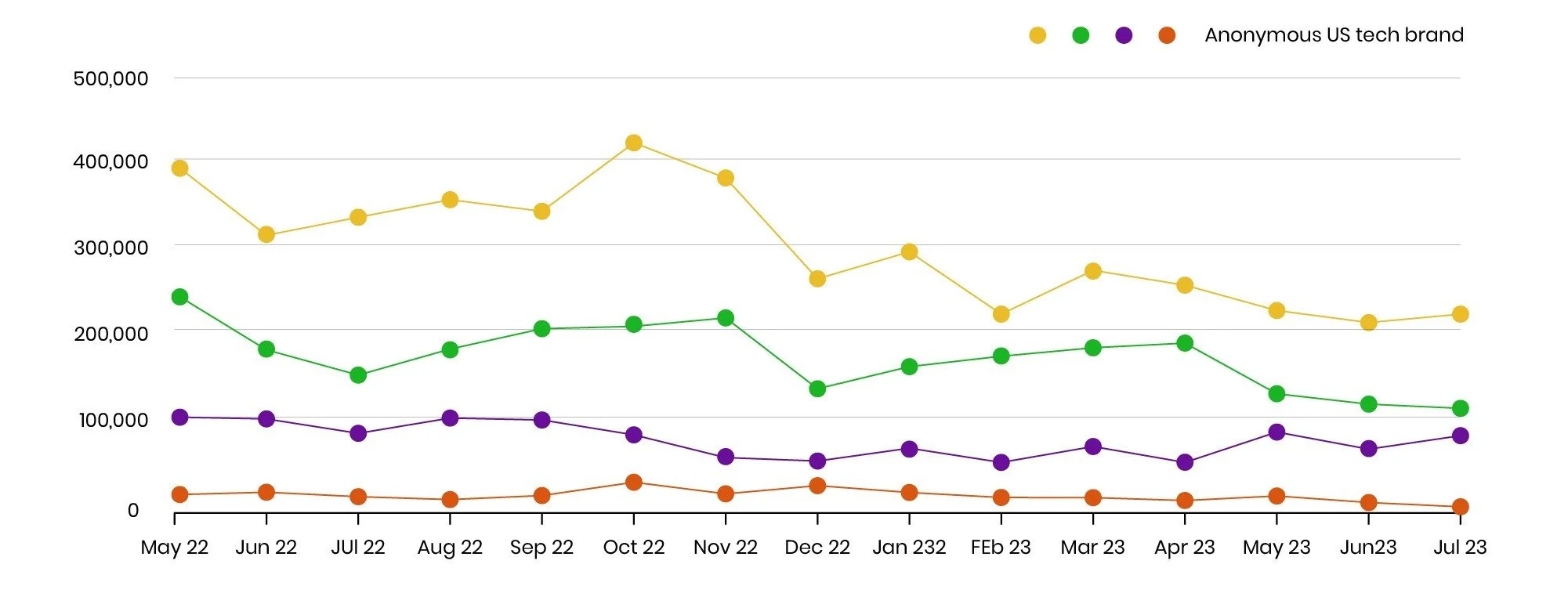

To quantify this research, we have looked B2B specific data points. The start point was a look at a selection of B2B tech brands in the US – where we are able to see further into trends around Q4 and the festive season in 2022. (The brands sampled have been anonymised)

When looking at traffic data within the B2B tech brands sampled we can see dips in traffic in December – however the volume of monthly traffic is still higher than the average of months in Q1 – showing audiences still engaging with brands throughout this period.

Audiences are still engaged, and where some brands look to pull back towards the end of Q4 – this is a great time to show consistency in the market with precise hyper targeting paired with relevant creative messaging.

There is also a real opportunity for brands to continue to gain market share and show consistency where competitors may be dipping out of the market.

When we look a little more closely at the B2B tech brands sampled, we can see visit duration which is in some instances is higher in December. This lends to December being more of a research month – which again shows time on site being stronger than other months in the year. With the B2B lifecycle becoming longer, the importance of being in market through this life cycle becomes synonymous.

2022-2023 Web Traffic Data - US B2B Tech Brands

Source: Similar Web 2022 US data

Visit Duration

Source: Similar Web 2022 US data

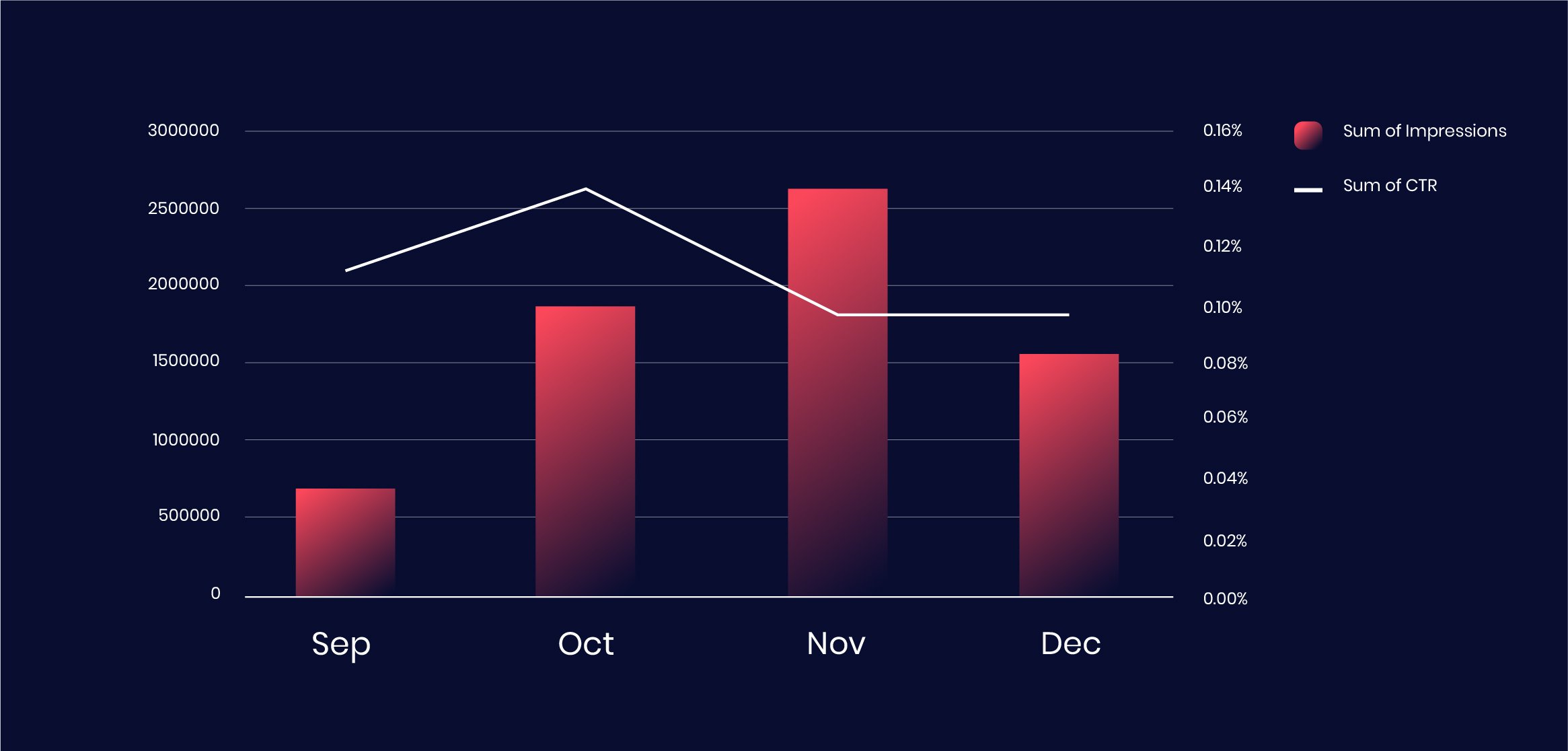

The final data point we have sampled is from our B2B Encore campaign data, looking at Q4 2022. Firstly we can see CTR range from 0.1% - 0.14% in the period sampled. However, when we dig a little deeper into the data, we can see December performance stays consistently strong with a similar CTR level to November. We also looked at attention-based metrics such as viewability and in view time, for the same B2B tech campaign, we saw these metrics all improve into December by around 3.6% (source: Moat). This provides us with another data point to support an always on approach in Q4.

B2B Encore Campaign Data - Q4 2022

How can Encore support Q4 activation.

With the need to be in market in the Q4 period – Encore as a B2B marketing specialist can help support brands in making sure they are in front of the right audience at the right time.

It is important to remember that there will be noise from B2C brands as they fight for share in the Christmas period. We are not looking to compete with these brands – but be present in the mix for when the BDMs and B2B decision makers when they are making work-based decisions. As discussed, some B2B brands will tend to pull out of the market towards Christmas – this research shows that this can be based on misconceptions and gives huge opportunity to gain market share & SOV in a less competitive landscape.

The way to ensure cut through will be a combination of precise targeting, relevant placements, and powerful data. With Encore’s exclusive 1st party data, we can activate against this to ensure your brand is appearing where your competitors are not.

*https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-multiplier-effect-how-b2b-winners-grow